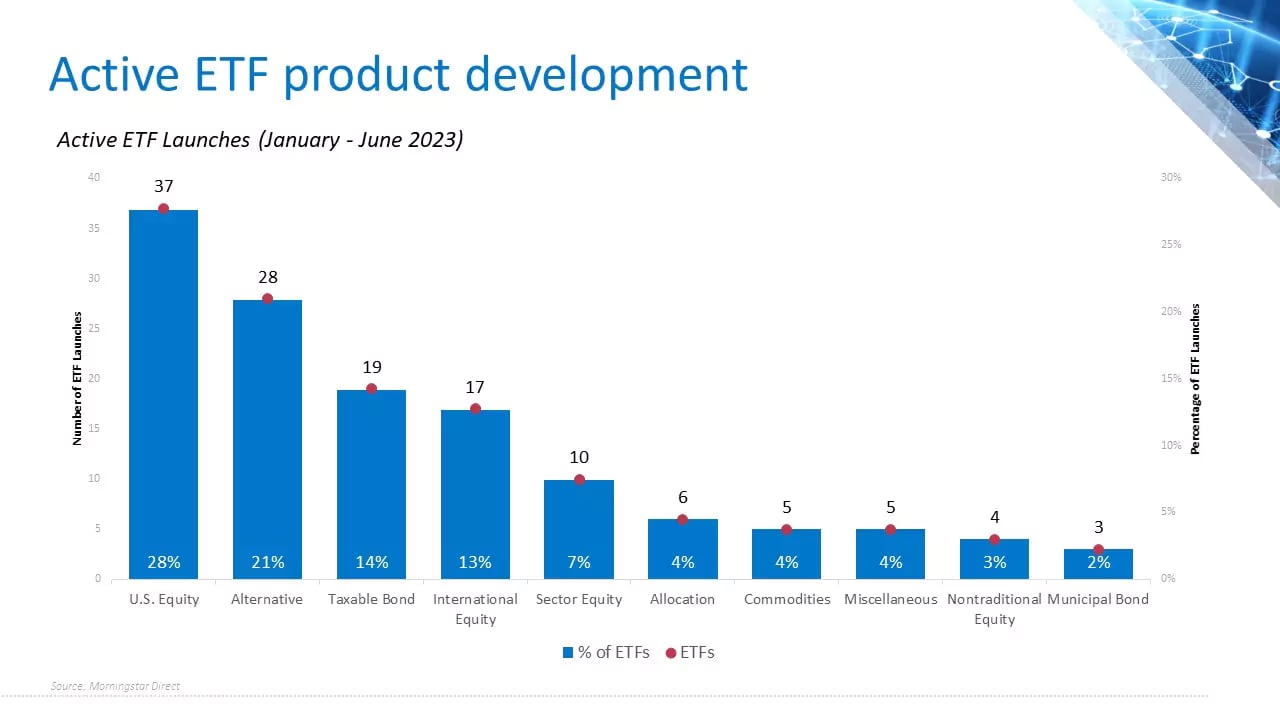

Actively managed strategies are a relatively new occurrence within the ETF industry, although the immense activity in terms of product development and disproportionate share of flows indicates that actively managed ETFs will probably drive the vehicle's growth in the near future. For perspective, as of June 30, active ETFs had $416B in net assets, which accounted for less than 6% of the US ETF market. These products, however, managed to garner 22% of total net flows after pulling in $416B in the first six months of 2023, according to data from Morningstar Direct. Additionally, of the 198 ETFs launched in the first half of the year, 134 (68%) were actively managed ETFs, with fully transparent strategies accounting for 95% (127 ETFs) of all active ETF development, also according to data from Morningstar Direct.

Therefore, it comes as no surprise that active ETFs were mentioned repeatedly by nearly all of the Heads of Product Management and Directors of Due Diligence who responded to our most recent Productivity Insights surveys. While the sentiments from respondents varied, with most coming out in favor of the structure, the overwhelming frequency of references informed us just how top-of-mind active ETFs, and more specifically active transparent ETFs, have become for the majority of managers and distributors.

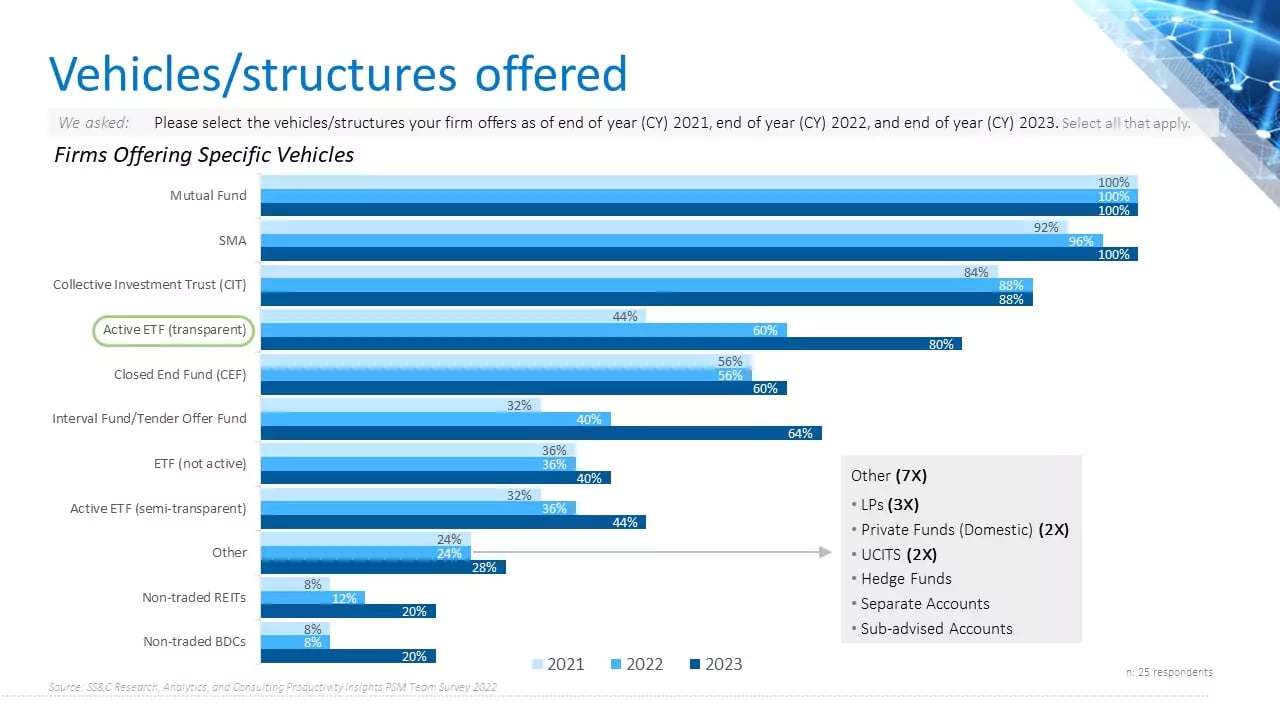

Looking at the various vehicles offered by the respondents from our Product Strategy & Management survey, you can see the percentage of managers offering active transparent ETFs nearly doubled from 44% in 2021 to 80% in 2023. The growth and quantity of firms offering active transparent ETFs may indicate that more and more firms have recognized that certain strategies do not suffer a loss of performance alpha from increased transparency and that some front-running concerns have been exaggerated. In the last 12 months, there has been a strong surge of active ETF launches and mutual fund to ETF conversions for strategies that can serve as core holdings in an asset allocation framework, such as broad-based equity and fixed-income products. However, recent ETF sales highlight opportunities in more specialized slices of both the equity and fixed-income markets for managers to bring their specialized expertise and track records to the ETF market.

Stay tuned for part two of this blog series, which will discuss transparent ETFs overtaking their semi-transparent counterparts to become the preferred active ETF structure of both managers and distributors. If your firm is working on its ETF strategy, SS&C’s Distribution Solutions group focuses on helping asset management firms find opportunity amid all of the disruption in the industry, as well as stay on top of industry trends.