BLOG. 4 min read

Retirement Income 2023 H1 Trends and Stats from SS&C's RICC Platform

July 31, 2023 by Jacqueline Rynn

Ryan Grosdidier, Business Development Lead contributed to this article.

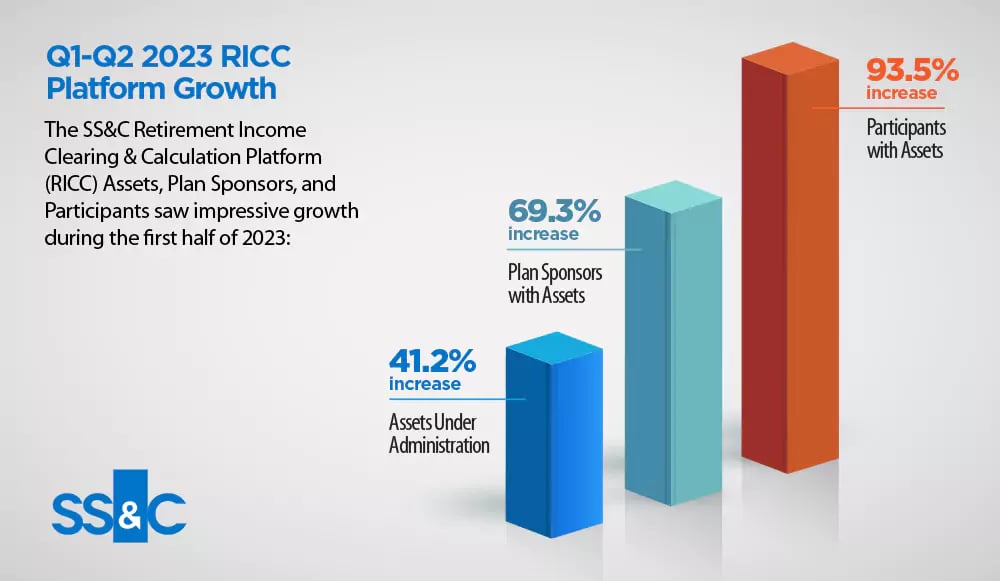

Retirement Income adoption trends by plan sponsors and participant utilization continued the strong momentum that we saw during 2022. As that momentum continues, we want to share some of the trends we’ve seen in recent months. The SS&C Retirement Income Clearing & Calculation Platform (RICC) Assets, Plan Sponsors, and Participants saw impressive growth during the first half of 2023:

- Assets Under Administration: +41.19%

- Plan Sponsors with Assets: +69.29%

- Participants with Assets: +93.48%

Although not yet reflected in these stats, we are excited to announce the connection of the Allianz Lifetime Income+ solution during the first half of 2023. As plan sponsors continue to evaluate guaranteed retirement income solutions with their recordkeeping partners and product providers, there are several important areas of consideration.

Type of Products Preferred Based on Participant Demographics: Planning for retirement and setting a retirement income strategy are very personalized decisions for participants, and therefore require a suite of solutions. Some participants prefer a “Do It Myself” approach and will benefit from educational information, tools, and calculators, as well as multiple retirement income solutions that fit their diverse needs. Other participants may take a “Do It With Me” mentality and would look for digital advice and guidance engines, along with call center or advisor support, that will serve up retirement income solutions and strategies based on their needs. Finally, a participant that is more hands-off or may be intimidated by saving and creating retirement income would value a “Do It For Me” program that may include a Managed Account Program or Dynamic Qualified Default Investment Alternative (QDIA).

Participant Experience & Microsites: Working with your recordkeeper and product partners, it is important to understand if the retirement income experience is being built natively into the core recordkeeping platform or if the experience is accessible via Single Sign On (SSO) from the recordkeeping platform. It is often a simpler and more scalable build to create a microsite or multiple microsite experiences, as it provides scalability across multiple solutions and structures.

Retirement Income Program Oversight: Is your recordkeeping partner owning the oversight of multiple retirement income solutions or are they leveraging a retirement income technology service provider or middleware provider to handle the program? There is a lot of value and scalability available when leveraging a partner who has experience working with multiple retirement income solutions and can handle the multiple connections and complex flow of data required. Retirement income technology service providers manage the file exchange between recordkeepers and insurers, ensuring they are received daily and processed successfully. APIs can also be leveraged to exchange information in support of participant transaction requests, to reconcile out-of-compliance transactions with both recordkeepers and insurers and to ensure the reconciliation of all benefit values on a per-participant basis.

Product Availability: What is your recordkeeper’s plan to connect to multiple retirement income solutions? Are they leveraging partners that will allow for a seamless one-to-many connection or are they connecting individually to a single solution? If your recordkeeping partner does not offer the solution that you are looking for, be sure to ask them when they plan to offer it; that way, they can prioritize which solutions to offer first.

Portability: What is your recordkeeping partner and product provider’s plan for addressing portability? It is important for plan sponsors to have a plan for participant portability for when they leave the plan and want to move their benefits with them. It is important to have a plan for recordkeeper portability in case a plan leaves its current recordkeeper and needs to maintain the benefits accrued by plan participants. Guarantees can be ported plan to plan, to an individual relationship with the insurance carrier, or to a companion product within an IRA. Finally, it is important to have a plan for product conversion—or how the plan will address the move from one product to another. Would the preference be to convert these balances to the new product or maintain a legacy solution along with new asset flows into the new product?

Working with recordkeeping partners, retirement income product providers and retirement income technology solution providers is essential to creating and maintaining a successful retirement income program for your plan and participants.

To learn more about Retirement Income Solutions, visit our "Retirement Income Clearing & Calculation Platform (RICC®)" solution page.

Written by Jacqueline Rynn

Head of Product Development, Advisor, Rollover and Retirement Intelligence Solutions